The Ministry of Finance is the government body responsible for formulating revenue policies of the State. The revenue policy is a key component of the broader fiscal policy. The government aims to formulate effective revenue policies to:

• Improve fiscal sustainability and self-sufficiency in line with the principles specified in Fiscal Responsibility Act

• Enhance public welfare, economic competitiveness, and climate resilience.

• Increase tax neutrality and strengthen progressivity of the tax system.

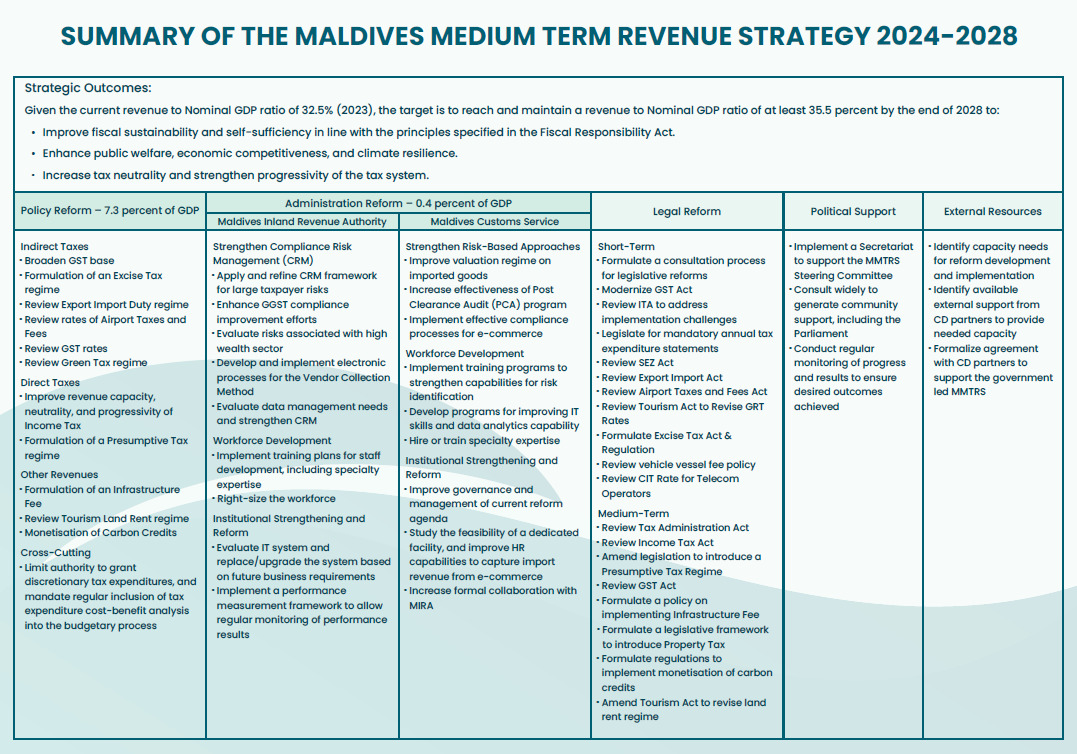

The Ministry of Finance has formulated the Maldives Medium Term Revenue Strategy (MMTRS) 2024-2028. This document aims to establish a whole of government approach in developing the Maldives vision for medium term revenue policies. With this MMTRS, the government aims to further strengthen the current revenue policies, and enhance domestic revenue mobilization. The publication of MMTRS demonstrates a move towards improving transparency of the governments decision making and will instill the confidence of among the stakeholders and signal stability in the economic environment. The table below summarizes the MMTRS.

Please refer to the document below for the full MMTRS:

Maldives Medium Term Revenue Strategy 2024-2028

The Maldives Inland Revenue Authority (MIRA) is responsible for collecting and implementing inland taxes in the Maldives. The Authority also collects most of the rents and fees charged by the Government. The MIRA was established in 2010 with the enactment of the Tax Administration Act (Law Number 3/2010).

Please visit the MIRA’s website for more information.

The Maldives Customs Service (MCS) is responsible for collecting and implementing duties and other customs fees and charges.

Please visit the MCS’s website for more information.

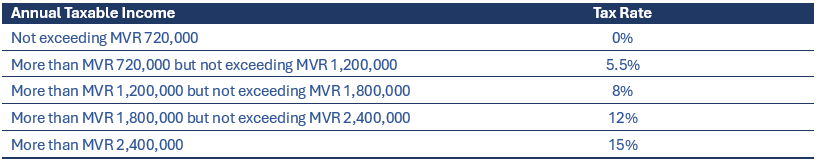

The income tax was introduced in the Maldives in 2019 with the ratification of the Income Tax Act (Law Number 25/2019), commencing from the year 2020. The comprehensive regime was established to extend income tax to individuals as well as businesses, and to complete the income tax regime of the Maldives while creating a means of reducing inequality and improving progressivity and neutrality of the tax system.

The income tax is charged at 25% on the taxable income of banks. Below are the tax rates and brackets available for individuals and persons other than individuals and banks.

Income that is exempt from Income Tax and expenses deductible in calculating taxable income are specified in section 12 and chapter 4 of the Act, respectively.

Payments that are made to non-residents by persons conducting business in the Maldives, specified in section 55 of the Act, are subject to non-resident withholding tax at 10% or 5%.

Please refer to the MIRA’s website for more details.

First Amendment to the Income Tax Act

Exemption under Section 12-1 of the Income Tax Act

The Goods and Services Tax (GST), introduced in 2011, is a tax charged on the value of goods sold and the services supplied in the Maldives, under the Goods and Services Tax Act (Law Number 10/2011).

A unique dual rate system is in place which distinguishes between general goods and services, and tourism goods and services. The General Goods and Services Tax (GGST) rate is 8%, which is applicable to all goods and services excluding tourism goods and services. The Tourism Goods and Services Tax (TGST) rate is 17%.

The exempt goods and services and zero-rated essential goods can be found in Chapter 4 and Schedule 1 of the Goods and Services Tax Act, respectively.

Please refer to the MIRA’s website for more details.

First Amendment to the Goods and Services Tax Act

Second Amendment to the Goods and Services Tax Act

Third Amendment to the Goods and Services Tax Act

Fourth Amendment to the Goods and Services Tax Act

Goods imported to the Maldives are subject to import duty as specified in the Maldives Export Import Act (Law Number 31/79). The duty charge may be ad valorem or specific or a combination of both. The ad valorem duty rate ranges from 0% to 400% of the value of the imported goods. Specific duty rates are charged on certain imported luxuries and on goods that are harmful to health.

The President has the discretion, under special circumstances, to waive import duty, or part of it, for certain imported goods.

Please refer to the MCS’s website for more details.

The green tax imposed under the Maldives Tourism Act (Law Number 2/99), are charged on a tourist per day of stay in a tourist establishment of the Maldives. With the thirteenth amendment to the Maldives Tourism Act, tourists who stay in a guesthouse or a hotel in an inhabited island with 50 or fewer registered rooms are charged USD 6 per day while tourists who stay in other types of establishments are charged USD 12, starting 1 January 2025. Children under the age of 2 years are exempt from green tax.

Please refer to the MIRA’s website for more details.

The green tax is deposited to the Maldives Green Fund; a trust fund established to earmark funds from green tax to spend on climate change mitigation measures and other environmental initiatives.

Sixth Amendment to the Maldives Tourism Act

Eighth Amendment to the Maldives Tourism Act

Eleventh Amendment to the Maldives Tourism Act

Twelfth Amendment to the Maldives Tourism Act

Fourteenth Amendment to the Maldives Tourism Act

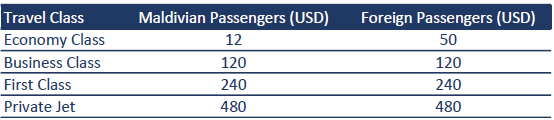

The departure tax and the airport development fee are charged based on the class of travel of a passenger departing from Maldives from an airport in the Maldives. Starting 1 December 2024, both the departure tax and airport development fee are charged at the following rates.

The airport development fee is only charged on passengers departing from the Maldives via the Velana International Airport. Passengers with diplomatic immunity and transit passengers on ‘direct transit’ are exempt from airport development fee. Passengers with diplomatic immunity, transit passengers and children under the age of 2 years are exempt from departure tax.

Please refer to the MIRA’s website for more details.

First Amendment to the Airport Taxes and Fees Act

Second Amendment to the Airport Taxes and Fees Act

Tourism land rent, imposed under the Maldives Tourism Act (Law Number 2/99), is based on the land area of islands and plots leased out to develop and operate tourist establishments. The rates vary from islands and plots leased to develop resorts, tourist hotels, yacht marina, and integrated tourism projects, and plots leased in inhabited islands. The rates also vary based on the geographic location of the island or plot, to incentivize development of tourism in remote regions.

Please refer to the MIRA’s and the Ministry of Tourism’s websites for more details.

Dividends are received from State Owned Enterprises (SOEs) from profits derived each year and are based on the dividends declared by SOEs. Dividends from SOEs represent a vital component of government revenue and shareholder returns.

Local Councils have the authority to charge rents and fees pursuant to the Maldives Decentralisation Act (Law Number 7/2010). As such, Local Councils may charge a fee for services provided by the councils and charge rent on land that falls within the Council's jurisdiction. Section 75(b) of the Maldives Decentralisation Act specifies the rents and fees that may be charged by councils.

As part of the revenue decentralisation process, the Government has transferred the collection of vessel and vehicle annual and registration fees to the relevant councils. Furthermore, the lease agreements relating to land that fall within council jurisdiction have been transferred to the relevant councils.

The international tax policies of the Maldives are designed to encourage cross-border trade, stimulate investment, and nurture business growth within the economy. Additionally, the Maldives is dedicated to facilitating international tax cooperation to avoid double taxation and combat tax evasion.

Actively participating in global initiatives targeting base erosion and profit shifting (BEPS), the Maldives ensures compliance to international tax standards and fosters cooperation among tax authorities.

The Maldives relies primarily on domestic legislation concerning international taxation, double tax avoidance agreements, and other agreements facilitating international tax cooperation, to govern its international tax policy.